The March 15th deadline to file your business income tax return is almost here. Have you filed your return yet? There is still some time left. Maybe you’re still waiting on documents, or maybe you’ve just been too preoccupied with work and life to prepare your return. Whatever the reason may be, the IRS will grant you tax extension to file your return in case you are not ready.

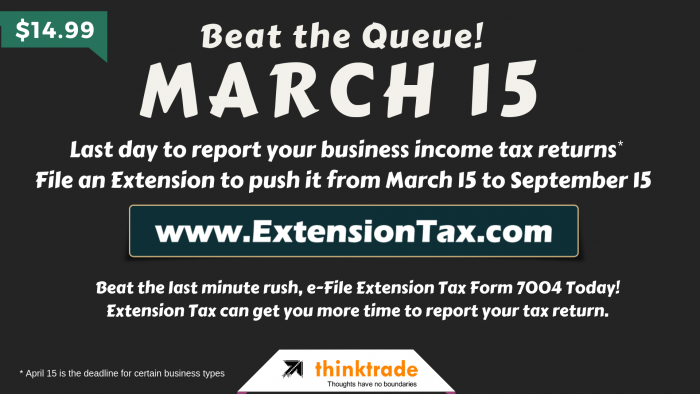

If you need more time to file your taxes, you should definitely request an extension sooner than later. It’s always better to extend than to file an incorrect return and have to amend it later. With that in mind, it’s important to note, filing an extension grants you additional time to file your return, but not to pay the tax due.

If snail mail isn’t your thing, you can e-file your extension using www.ExtensionTax.com and make an estimated payment online using IRS Direct Debit Payment Option. ExtensionTax offers a secured service that lets you pay directly from a checking or savings account, and will send you an instant confirmation that your extension request was accepted and your payment was submitted. Just make sure you choose the correct form and tax period to let the IRS know where to apply your payment.

It is challenging to calculate the estimated amount-due to be paid if you’re not prepared to file, but if your tax situation has not changed much since last year, you can send the same estimated amount with your extension tax form 7004 and extend your filing date.

If you didn’t file for an extension by March 15th deadline, your extension request won’t be accepted by the IRS. So just do whatever it takes to e-file your 7004 return right away, the sooner the better. Remember, a return that is filed even one day late is considered late and the penalty will be levied by the IRS. Don’t waste several thousand dollars that you would likely owe in penalties if late, e-file Form 7004 for just $14.99 and take some extra time to review your return to make sure everything is complete before sending it in.

Talk to us at 1-866-245-3918 (toll free) for any assistance or write to us in support@extensiontax.com.

“Its tax time again, Americans: time to gather up those receipts, get out those tax forms, sharpen up that pencil, and stab yourself in the aorta” – Dave Barry.

“Its tax time again, Americans: time to gather up those receipts, get out those tax forms, sharpen up that pencil, and stab yourself in the aorta” – Dave Barry.

“This is the season of the year when we discover that we owe most of our success to Uncle Sam” – The Wall Street Journal

“This is the season of the year when we discover that we owe most of our success to Uncle Sam” – The Wall Street Journal