The Boston Marathon explosions have left a strong impact on the lives of people that were a part of it. Usually conducted on the third Monday of April i.e., on the Patriots’ Day it is one of the world’s best racing events well participated and viewed by people from various parts of the country. This year the racing event ended with much distress and agony after the two explosions that occurred near the finishing line. However, as a sigh of relief, the Internal Revenue Service has extended the tax filing time to 3 months for taxpayers residing in the Boston area and those affected by the explosion.

The announcement made by the IRS about the automatic extension of the tax filing date by three months can bring in some relief to the taxpayers who have been affected by the twin explosions in Boston Marathon. This tax extension of three months applies to taxpayers residing in Boston, as well as in and around the city such as Suffolk county and Mass. Moreover, the increase in the tax deadline even applies to the sufferers, their family members, casualty providers, and everyone who have been a part of the disaster. Taxpayers can visit IRS.gov for additional information about the automatic extension of the tax filing date.

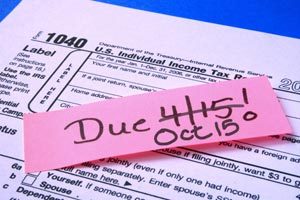

It is surely heart touching to see the aftermath caused during the Boston Marathon on April 15th, 2013. The now IRS acting commissioner, Steven T. Miller has also expressed his grief towards the affected individuals, therefore, have decided to give them an additional three months time for filing their tax returns. Therefore, taxpayers concerned about paying taxes can stay relieved by the announcement made by the IRS. In simple words, taxpayers are not subjected to any dues or penalties if they file their tax returns before July 15th, 2013.

Individuals residing in Suffolk County are not required to take any action, as this rule automatically applies for them. However, individuals residing outside the Suffolk County should call the IRS @ 1-866-562-5227 before April 23rd to know if they are eligible for the relief declared. Additionally, taxpayers who have received a penalty notice can call the IRS to enquire about the same. Moreover, they always have the option to e-file for tax extension by July 15th, 2013 and get an extension up to 6 months. We at ExtensionTax.com have developed a user-friendly e-filing system that can help taxpayers file tax form 4868 from the comfort and convenience of their house. Reach us @ 1-866-245-3918 for any queries or suggestions.

Time and tide waits for no one but you can make your Personal Income Tax filing Deadline wait for 6 months by simply E-filing Form 8468 through www.Extensiontax.com .IRS form 4868 is officially termed as the “Application for Automatic Extension of Time to file U.S Income Tax Return”. This is a tax extension form designed for individuals filing for income tax to the IRS. Any individual has the benefit of getting a tax extension for the tax form listed below:

Time and tide waits for no one but you can make your Personal Income Tax filing Deadline wait for 6 months by simply E-filing Form 8468 through www.Extensiontax.com .IRS form 4868 is officially termed as the “Application for Automatic Extension of Time to file U.S Income Tax Return”. This is a tax extension form designed for individuals filing for income tax to the IRS. Any individual has the benefit of getting a tax extension for the tax form listed below: